Report by Amit Chopra, Managing Director Shoes & Accessories

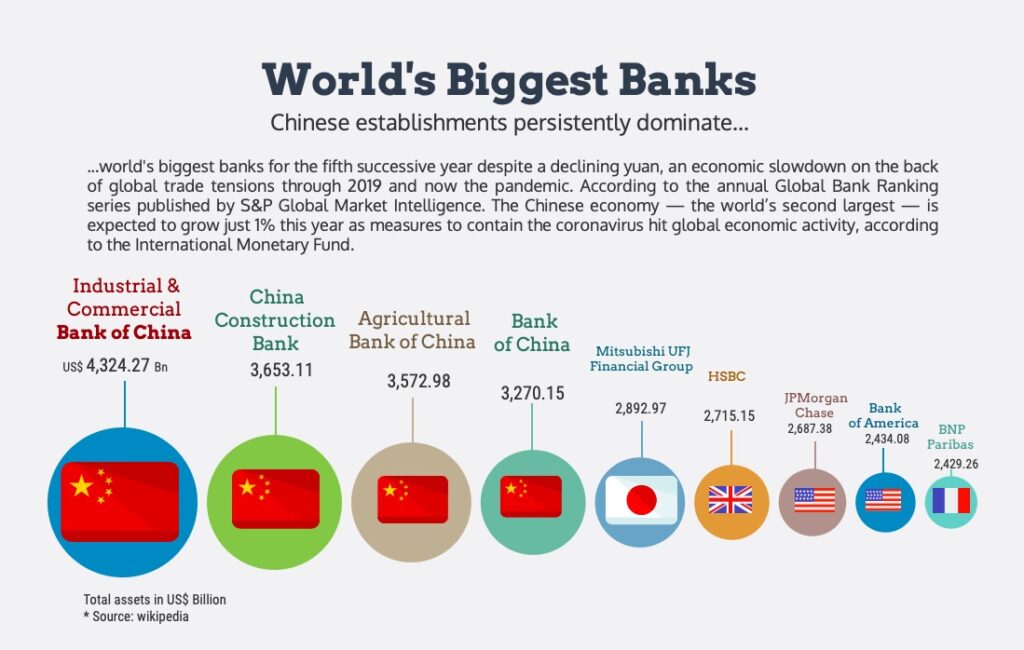

The Financial Power

China already has the world’s largest banking assets of $42 trillion, and China is the world’s largest economy when measured by Purchasing Power Parity, which takes into account how much the same basic items cost in each nation.

China’s Sovereign Wealth Fund is already worth $1 trillion, invested in government debts in other nations or ownership of global companies. You should expect China to go on a spree of buying up assets in Europe, America, Africa, Indonesia and other emerging markets – whether land, mineral rights, utilities, infrastructure, factories or service companies. In addition, China’s largest corporations will seize majority stakes in major competitors across Europe and America over the next 15 years.

We will continue to see bold, visionary moves by the Chinese government, resulting in giant nation-wide industrial enterprises and breathtaking infrastructure projects. China will continue to spend between 6‒8% of GDP on infrastructure for the next decade.

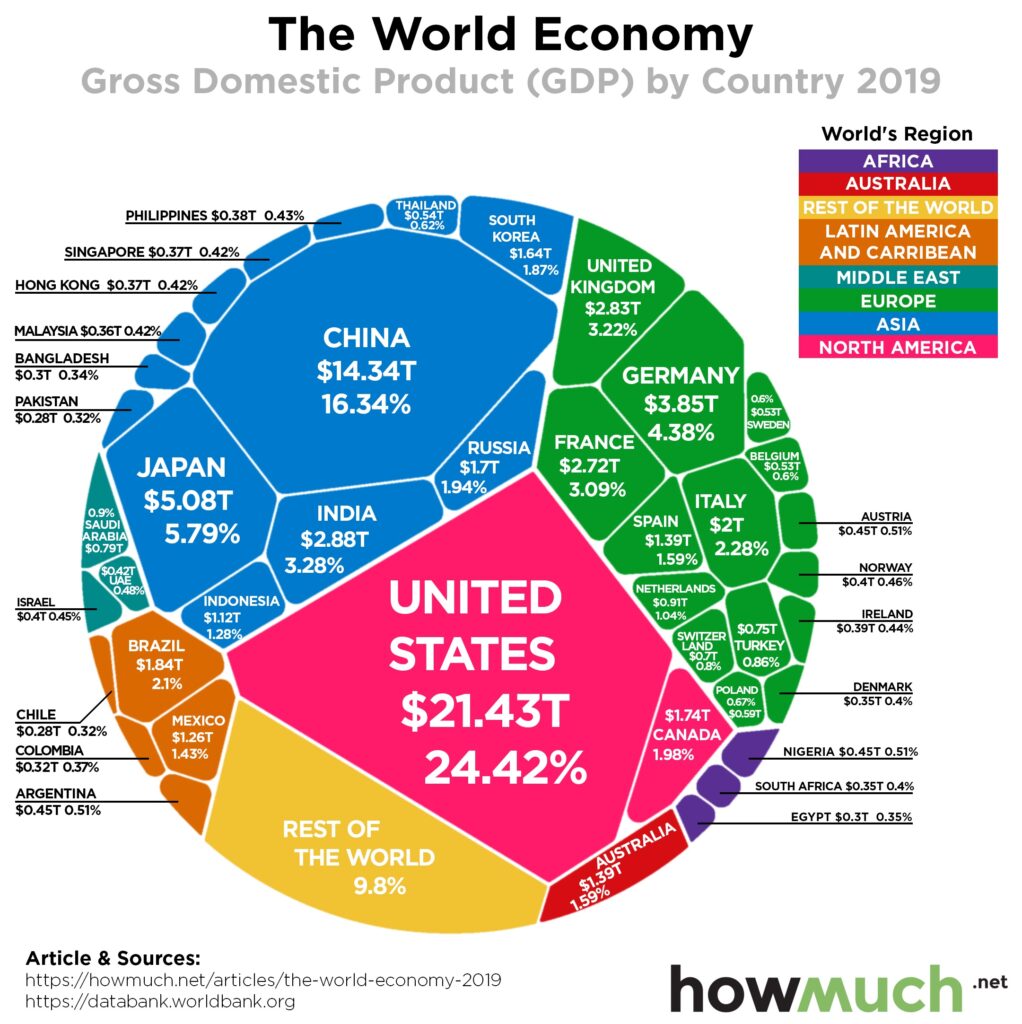

The World Economy

China’s economy grew from 2018 to 2019 to $14.34. The rest of the world’s economic powerhouses have comparatively much smaller economies, including Japan ($5.08T), Germany ($3.84T) and India. The U.S. remains by far the largest economy in the world with a GDP of $21.43T or 24.42% of the entire globe.

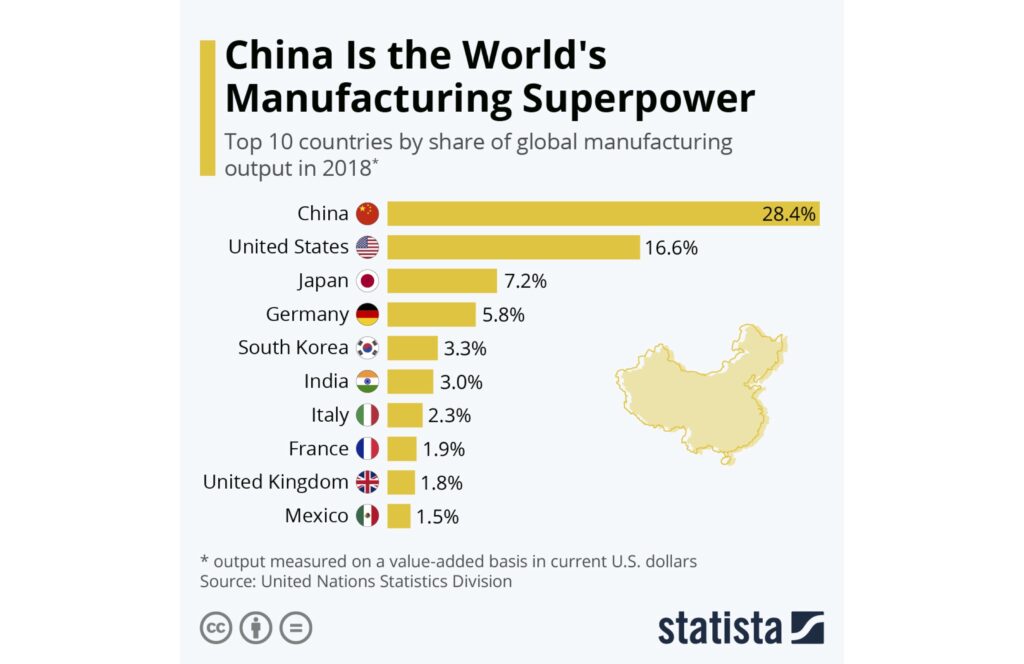

World’s largest Manufacturer- Exporter

Global markets are dominated by the abundance of Chinese products. China is still, by far, the largest exporter in the world. The country exported a total of $2.5 trillion worth of goods in 2018.The largest U.S. export industries include food and beverage, crude oil, civilian aircraft, auto parts, and industrial machines.

- Abundance of lower-wage workers

- Business ecosystem of networked suppliers, component manufacturers, and distributors has evolved to make it a more efficient and cost-effective place to manufacture products.

- Chinese manufacturers generally operate under a much more permissive regulatory environment.

- China has been accused of artificially depressing the value of its currency in order to keep the price of its goods lower than those produced elsewhere.

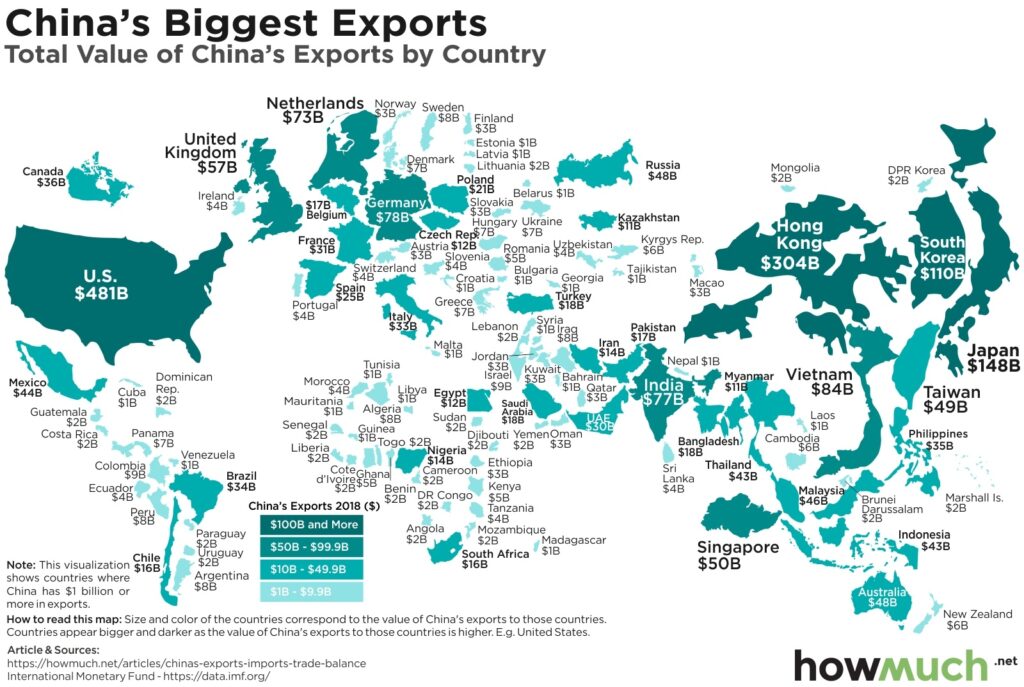

Biggest Trading Partner

Despite the trade war that has been raging between the U.S. and China since 2018, the U.S. still imports almost half a trillion dollars’ worth of goods from China. When combined, goods from China, Mexico, Canada, and Japan account for more than half of U.S. imports.

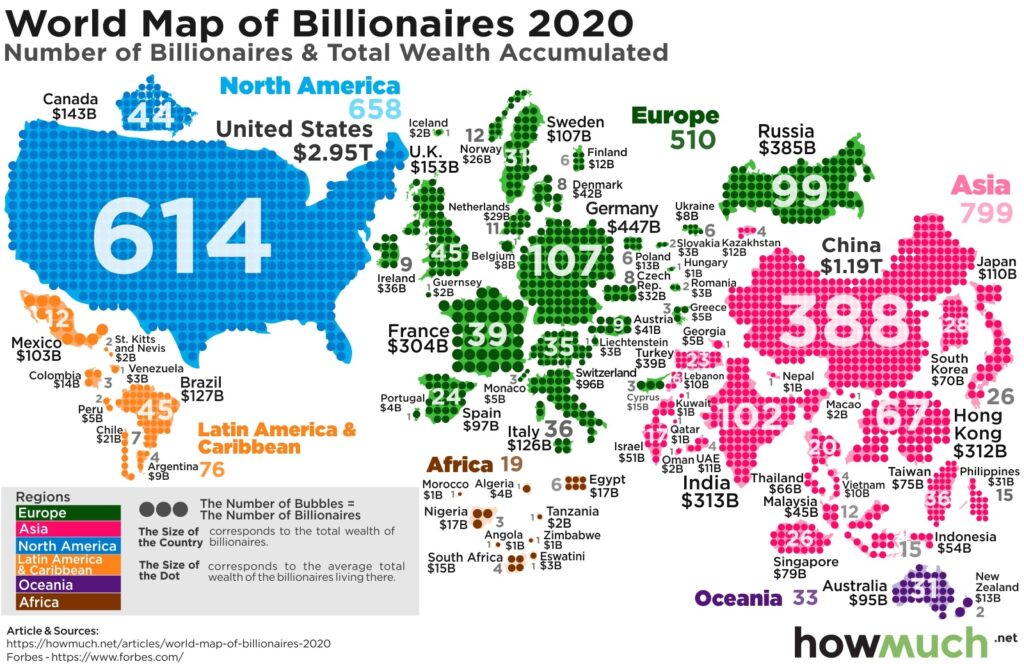

Billionaires In One Map

According to Forbes, as of March 18, 2020 there were 2,095 billionaires worldwide. The total net worth of the world’s billionaires is $8 trillion, $700 billion less than the previous year. There are 58 fewer billionaires than a year ago and 226 fewer than at the beginning of March. This is in large part because of the economic meltdown in the wake of the coronavirus. More specifically, 51% of the billionaires on the list are “poorer” than they were in 2019.

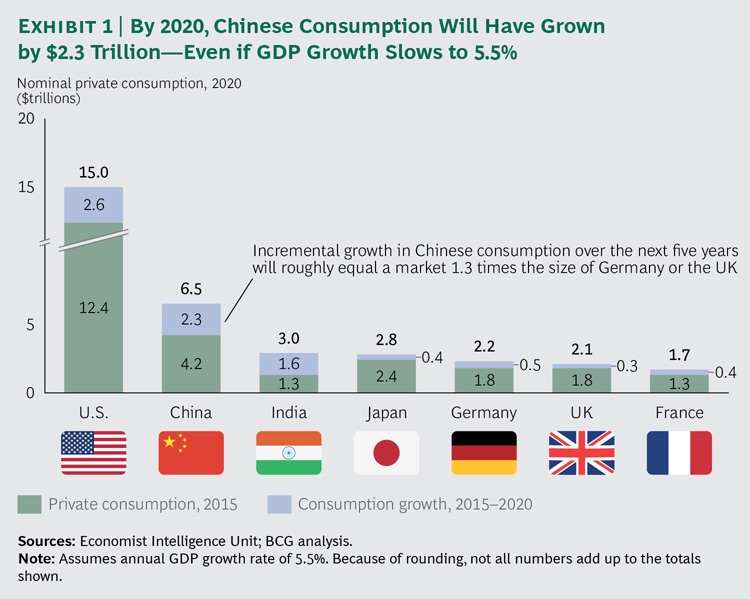

World’s Fastest-Growing Consumer Market

From export-led growth to domestic-market dominance

China is expected to surpass the US as the world’s largest consumer market soon. In 2019, Chinese people’s spending on lifestyle and household products is on the rise, especially showing huge potential in fourth- and fifth-tier cities. In 2018, the consumption scale gap between China and the US has narrowed to $280 billion. Online sales in the US were $7.4 billion on Black Friday shopping spree, while the figure from Alibaba’s platform reached $3.83 billion for the Chinese Singles Day shopping event. Chinese people will spend which $1.8 trillion online by 2022. Alibaba is the largest online retailer in China, with revenues growing by around 50% a year, over $40bn in 2018, (compared to $180bn for Amazon), with 600 million registered accounts and 100 million e-commerce shoppers every day, representing 60% of all China’s e-commerce. (Extract from New edition of “The Future of Almost Everything” )

Strong Leadership

China has had strong leadership for the past many decades. Post Chairman Mao reign, the present President Xi Jinping is the most authoritative leader that China has had. Since 1979, his economic reforms of breaking up state monopolies and ensuring greater equality has made China the most powerful state.

“Made in China 2025”

Xi Jinping’s China is changing at a phenomenal rate and the plan “Made in China 2025” to make China a great industrial power has never been on such a good path as it is today. China’s government has initiated a string of policies on technological advancement to boost a process of catch-up with more advanced economies. In early March, President Xi Jinping delivered a keynote speech which included major initiatives in the development of the “industrial internet,” including policies for the construction of a new digital industrial infrastructure. 5G networking would become the cutting-edge technology applied in transforming China’s industrial internet across large vertically-integrated industrial enterprises. In line with Xi’s policy direction, one of China’s leading internet operators, Alibaba Cloud, has been constructing 10 industrial internet platforms for various industry sectors, including textiles, clothing, food and beverage, processing, home appliances, electronics, and textile printing and dyeing.China’s National Development and Reform Commission (NDRC) launched the “Digital Transformation Partnership Action Plan 2020”, it’s been designed to help small and medium sized enterprises (SMEs) overcome difficulties in adapting to digital transformation.

The Power Push

China will expand its regional influence, largely through economic means. China is unlikely to be as territorially or militarily ambitious as other superpowers have been in the past, except in the case of sparsely populated islands, which would enable it to extract new energy or mineral resources.

Chinese multinationals to grow

We can expect ongoing complaints by many global businesses and smaller investors that business is difficult in China and now the blame to have created the virus – Covid19 which threw the world into a pandemic. 2021 might see a few multinationals pulling out of China completely. Primarily, due to hostility by Chinese government to companies that take profits out of China, inconsiderate attitude to intellectual property and lack of transparency in business dealings. Already the US is wary of the Chinese government for spying via apps and IT firms. However, all this still might not stop the Chinese companies to go aggressive internationally.

Amit Chopra Co-Founder – Shoes & Accessories

A professiona & lifestyle specialist with 30 years of experience in management, product, marketing, Brand Launches & sourcing in Retail industry. He has been instrumental in creating landmark changes in the footwear Industry in India through his experience in the sector and different aspects of business.