WORLD FOOTWEAR SURVEY 2020

By Portuguese Shoes

ABOUT THE SURVEY

In 2019 the World Footwear created the World Footwear’ experts panel and is now conducting a Business Conditions Survey every semester.

The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and then to redistribute such information in a way it will provide an accurate overview of the situation of the global footwear industry.

The second edition of this online survey was conducted during the month of March 2020. 129 valid answers, 41% coming from Europe, 31% from Asia, 16% from North America and the remainder from other continents were obtained. Almost 40% of the respondents are involved in footwear manufacturing (manufacturers), 17% in footwear trade and distribution (traders) and 43% in other footwear-related activities such as trade associations, consultancy, journalism, etc. (others).

EXECUTIVE SUMMARY

Since the previous edition of this bulletin, in January, the Covid-19 epidemic has strongly dented the world economy and the footwear business with it. This is evident in the survey.

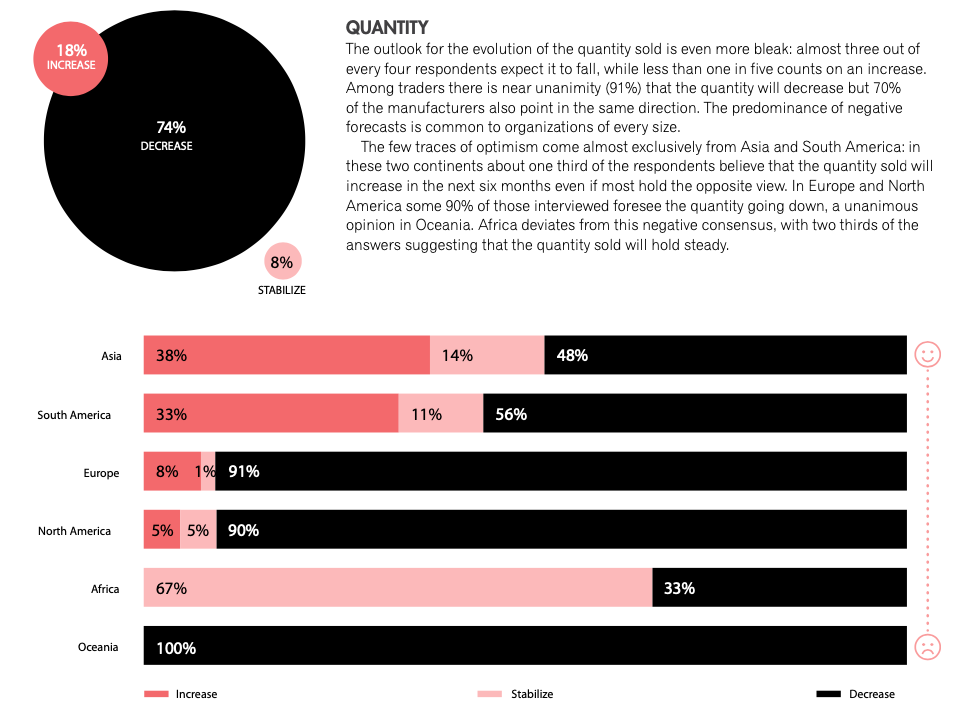

Most of the panel members believe that over the next six months the quantity of footwear sold will fall and prices will decrease. Perspectives are everywhere negative but particularly so in Europe, where 9 out of every 10 respondents expect the quantity of footwear sold

to diminish. Weak demand is now the experts’ main concern, pushing competition in international markets to the seventh position in the list of the footwear business difficulties that it previously led. Almost half of those interviewed also mention financial difficulties.

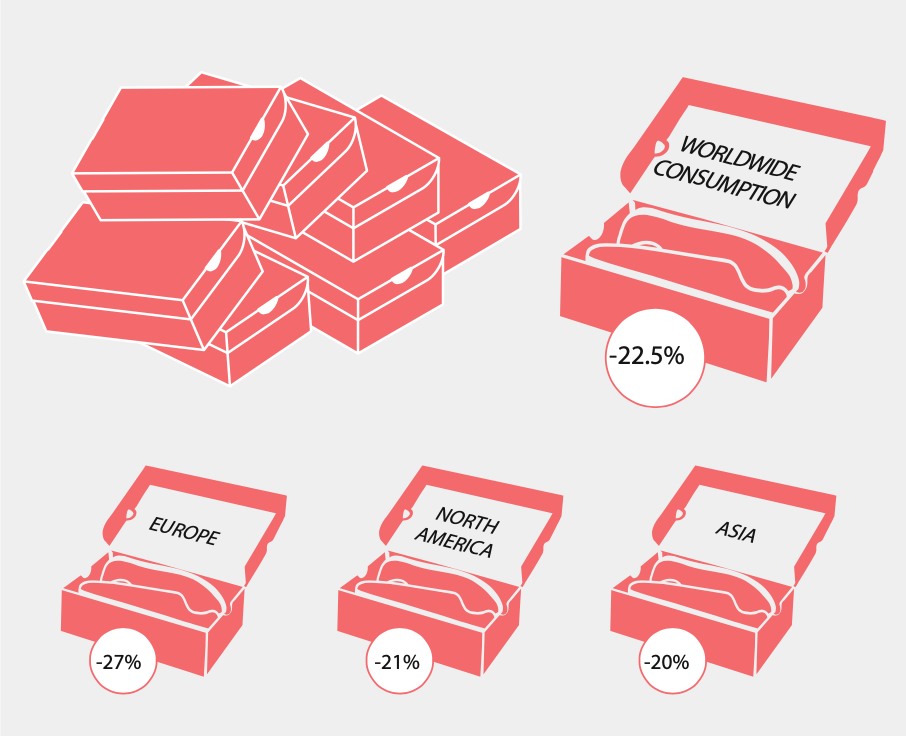

When questioned specifically about the impact of the epidemic on consumption, as compared to a no-epidemic scenario, the panel members, on average, are forecasting a 22.5% reduction, with some regional variation. Should these forecasts prove accurate, footwear consumption this year will fall by 696 million pairs in North America, 908 million in Europe, and 2.4 billion in Asia.

Most respondents also believe the epidemic will have lasting consequences for the location of footwear production with firms diversifying their sourcing among multiple countries, to reduce risk, or bringing production closer to the consumer markets.

BUSINESS CONTEXT

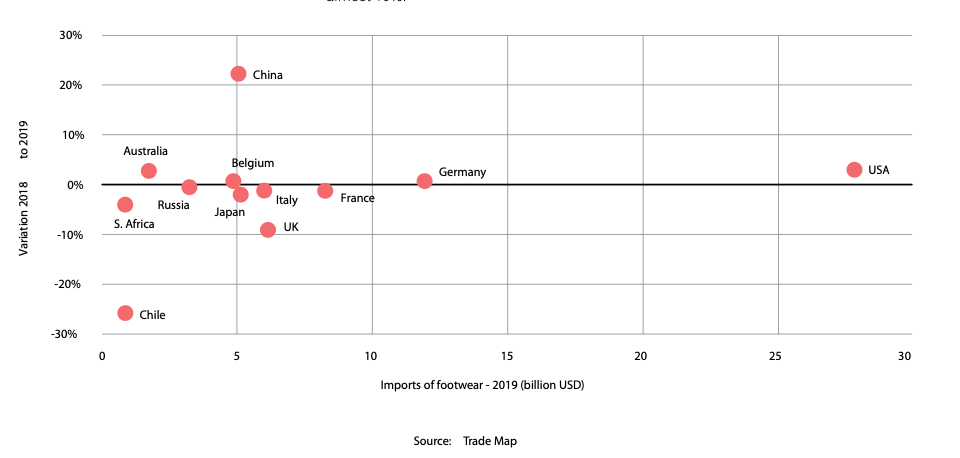

As they become available, statistics for footwear trade in 2019 are showing a mixed picture. Imports to the USA market, the largest in the world, grew by 2.4% on the previous year, as also did imports to Australia. In Asia, imports grew more than 20% to China but fell by 2% to Japan, both countries now slightly surpassing 5 billion dollars. The South African and, especially, the Chilean markets registered significantly negative growth rates. In most European countries, there was little change (growth rates between -1.5% and +0.5%) but imports to the UK fell by almost 10%.

Back in January, the International Monetary Fund was estimating the growth of world economy in 2019 at 2.9% and projecting that it would increase to 3.3% in the current year, which would have been good news. Since then, however, the Covid-19 epidemic has led to a steep degradation of economic perspectives. In this edition of the Business Conditions Survey we have a first glimpse of how the epidemic is hitting the footwear business.

IMPORTS OF FOOTWEAR

2019 VS 2018

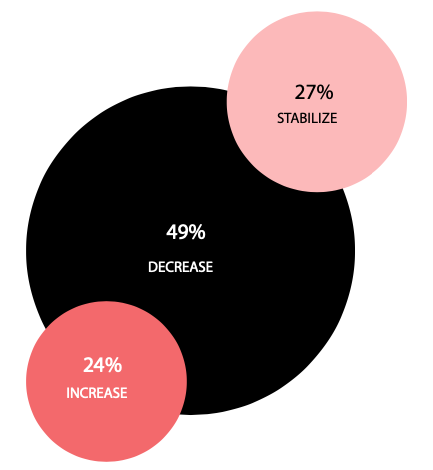

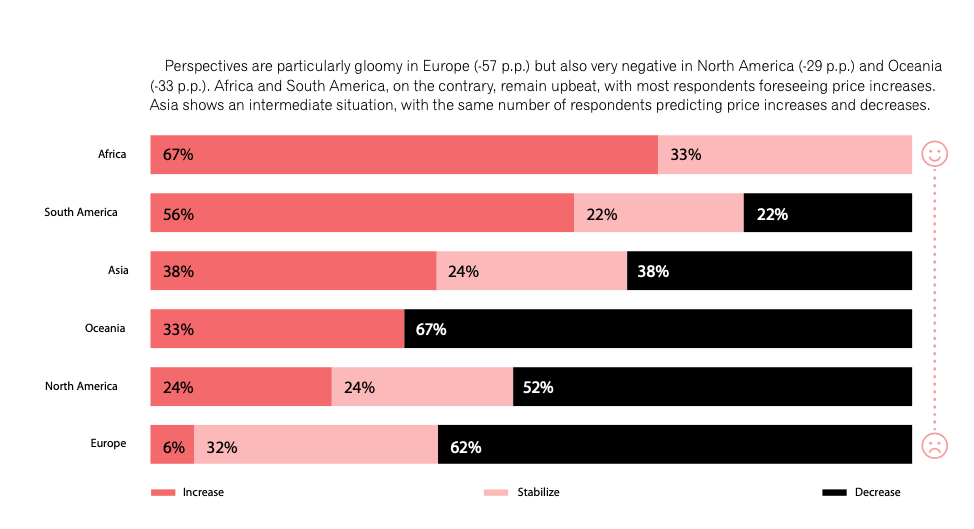

The perspectives of the panel members for the evolution of footwear prices in their countries over the next six months have deteriorated markedly since the previous edition of this bulletin, published in January. Whereas before the majority of the respondents expected prices to stabilize, and more expected them to increase than to decrease, now almost half are predicting that prices will fall. This negative sentiment

is independent of the respondent’s line of business but slightly more pronounced among traders (balance of positive to negative answers of -36 percentage points – p.p.) than manufacturers (-28 p.p.).

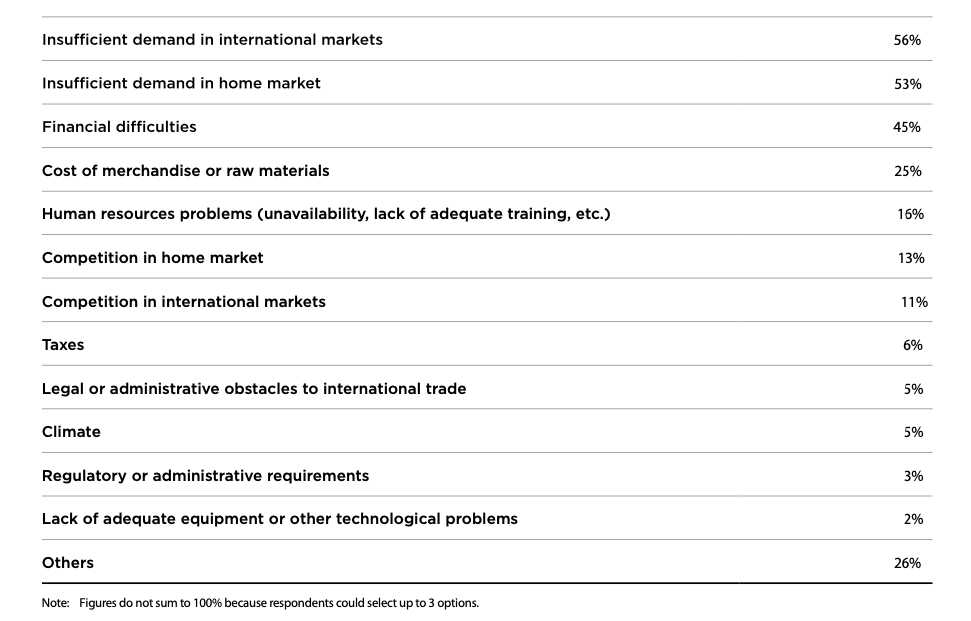

DIFFICULTIES

The degradation of the economic conditions worldwide together with the restrictions on the normal operation of firms and on the movement of people imposed in many countries in response to the Covid-19 epidemic explain the sudden rise of “insufficient demand” to the top of the difficulties faced by the footwear business: more than half of the members of the panel mention these problems. There was also a sharp increase in references to “financial difficulties”, from 22% in the previous edition of this survey to 45% now. Moving in the opposite direction, “competition in international markets” fell from first place, with 39% of references, in December 2019 to the seventh position now, with only 11%. All other factors identified in the table below also gave way in face of the demand crisis.

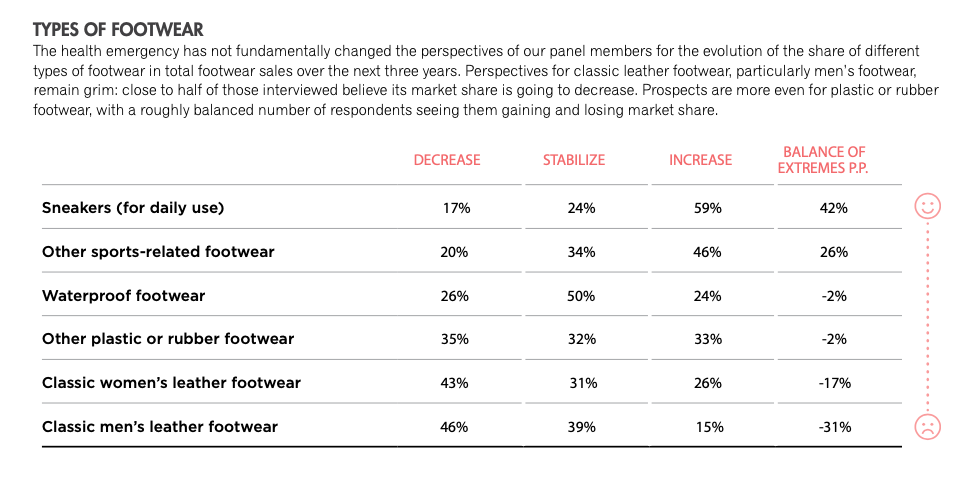

The panel continues to believe that sneakers and other sports-related footwear is going to gain market share in the near future. However, the balance of extreme answers for these two categories of footwear decreased considerably compared to the previous edition of the bulletin: it is too soon to tell whether this corresponds to some ebbing of the upward trend they have been showing for some years or is just a short-term fluctuation.

POSSIBLE EXPLANATIONS

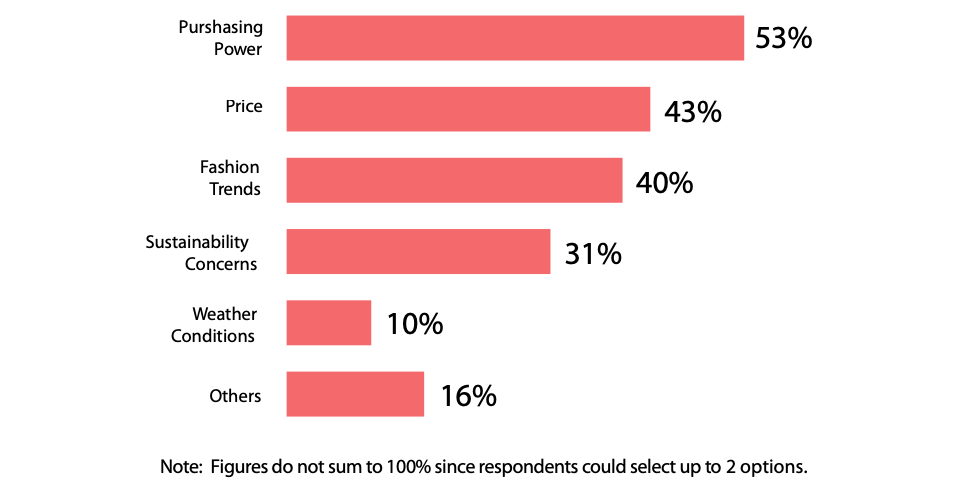

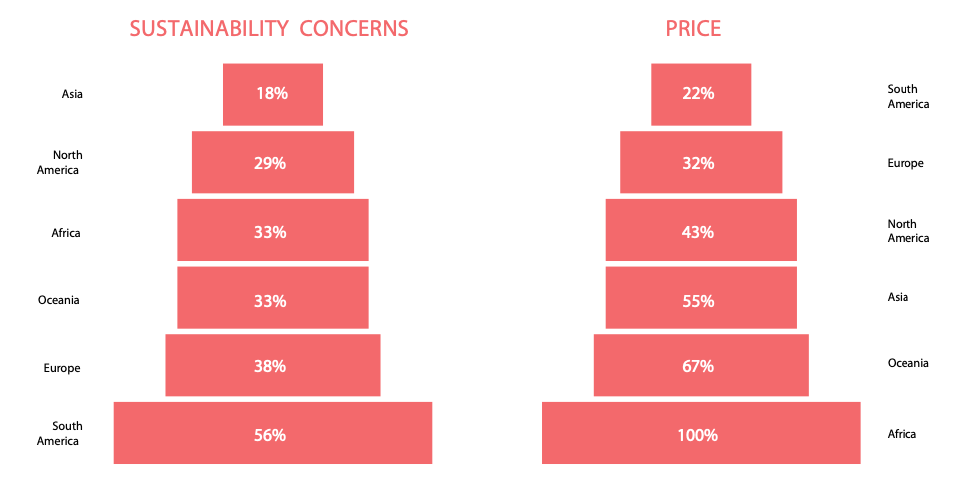

Asked about what factors drive the trends they forecast for the sales of each type of footwear, the experts place consumers purchasing power on top: in South America, especially, there is near unanimity about the importance of this factor. Price comes in second place and is most frequently mentioned by respondents from Asia and Africa. It is closely followed by fashion trends: these grab more answers from traders than manufacturers. About a third of those interviewed believe sustainability concerns explain the evolution of the sales of the different types of footwear: this is most commonly mentioned in South America followed by Europe.

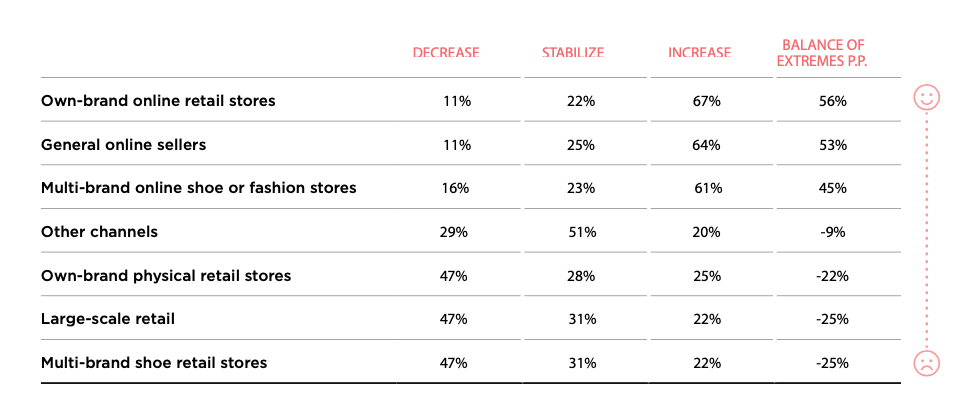

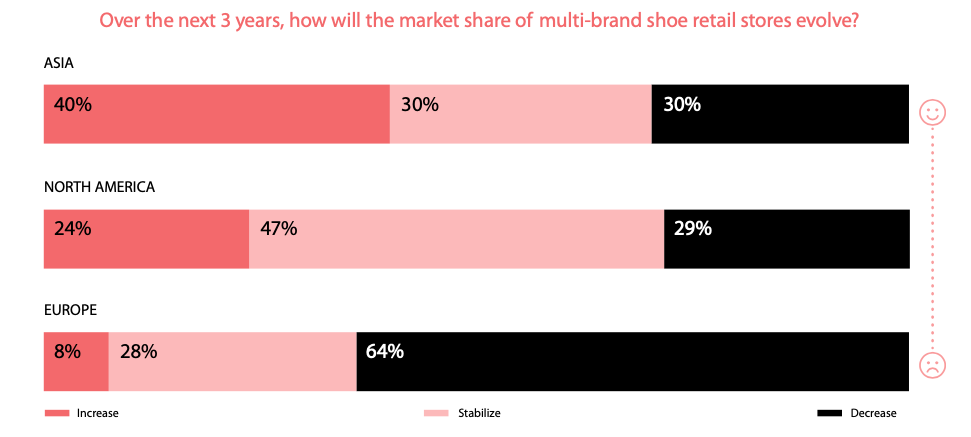

These perspectives show considerable regional variation. European respondents are much more pessimistic about multi-brand shoe retail stores than those interviewed in other continents. The balance of “increase” to “decrease” answers is -56 percentage points in Europe, but only -5 p.p. in North America while in Asia it is actually positive (+10 p.p.).

Impact of Covid 19

The consequences of the Covid-19 epidemic were inevitably the special topic of this edition of the World Footwear Business Condition Survey.

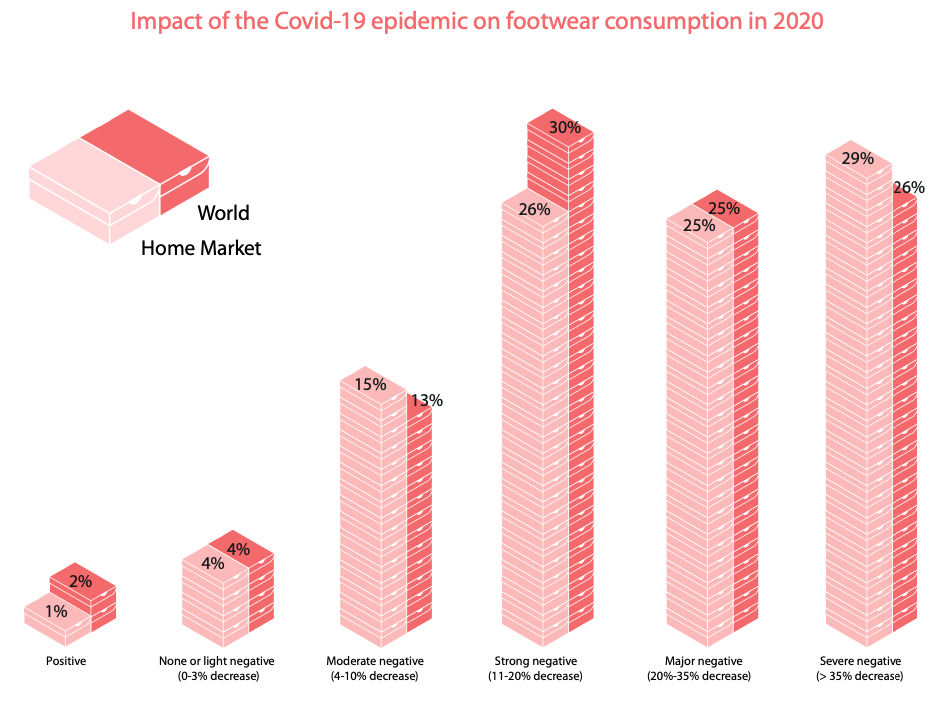

The members of the expert panel were questioned about the likely impact of the epidemic on footwear consumption in 2020, as compared to a no-epidemic scenario. Answers are rather preoccupying: most of those interviewed believe that consumption will fall by, at least, 20%; one in four believes that it will plunge by more than 35% worldwide. Pessimism is common to all categories of panel members.

On average, the World Footwear’s Panel of Experts is forecasting that footwear consumption worldwide will fall by some 22.5% in 2020. Estimates for Europe (-27%) are a bit more pessimistic than for North America (-21%) and Asia (-20%). Applying these percentages to the consumption by continent reported in the World Footwear Yearbook 2019, should these forecasts prove accurate, footwear consumption this year would fall by 696 million pairs in North America, 908 million in Europe, and 2.4 billion in Asia.

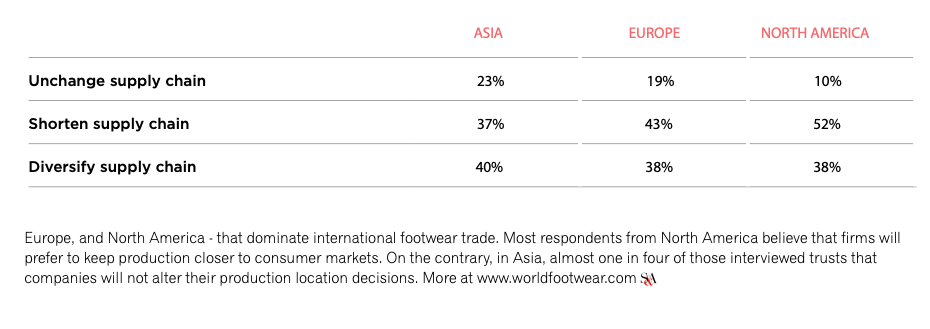

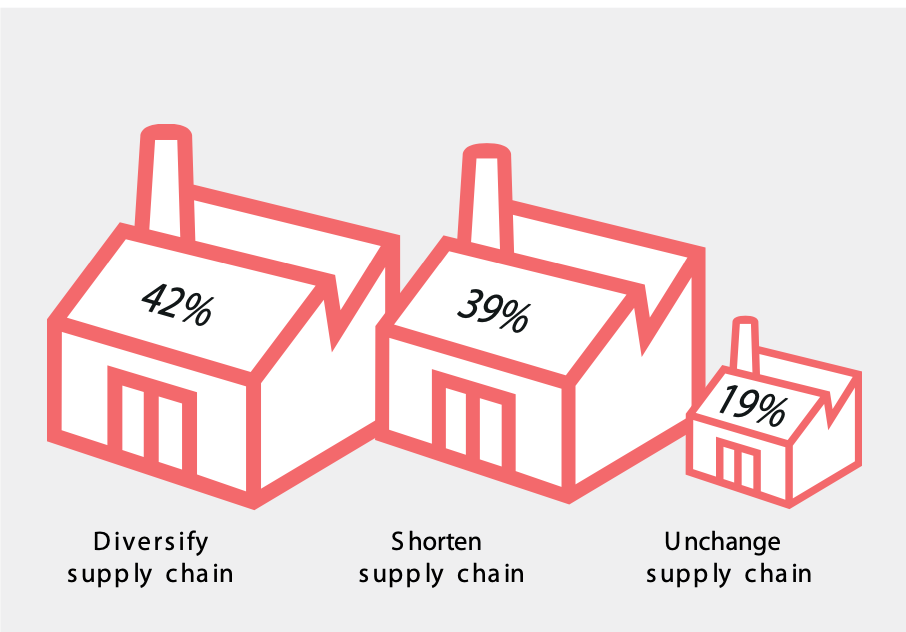

The footwear industry must therefore prepare for an extremely demanding scenario, as the difficulties in production that result from efforts to contain the epidemic will be coupled with an unprecedented drop in demand. The survey also wanted to find out about more lasting consequences of the epidemic. The panel members were questioned on its likely impact on firms’ medium-term decisions regarding the location of footwear production. Less than one in five of our experts believes the epidemic will have no impact on the location of footwear production (unchanging the supply chain). Others split almost equally between the option that firms will prefer to disperse production by different countries (diversifying the supply chain) to minimize the risk of disruption in their supply chains, and the possibility that firms will prefer to locate production close to the consumer markets (shortening the supply chain).

North American respondents are the least inclined to believe that things will remain unchanged, among the three continents – Asia,