New York, March 5, 2024

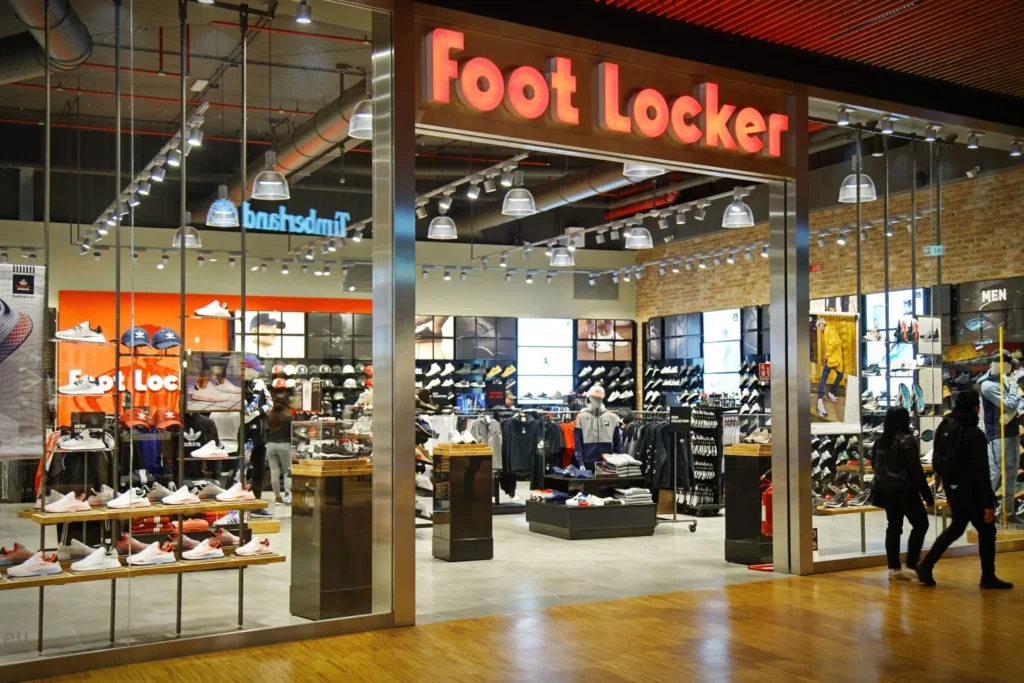

Foot Locker, Inc. has reported a modest uptick in sales for the fourth quarter of its financial year, ending February 3, 2024. The company’s President and Chief Executive Officer, Mary Dillon, expressed satisfaction with the quarterly results, citing accelerated sales trends and improvements across multiple key performance indicators.

“In line with our Lace Up Plan, we are pleased to announce fourth-quarter results that exceeded our expectations,” commented Mary Dillon. “We observed meaningful improvements in sales trends, driven by full-price selling and compelling promotions, as well as proactive inventory management strategies.”

Fourth Quarter Results

During the quarter, Foot Locker’s total sales rose by 2.0% to $2.38 billion, compared to the same period in the previous year. Excluding the impact of foreign exchange rate fluctuations, total sales increased by 1.5% year-over-year. However, the company reported a slight decline of 0.7% in comparable sales, attributed to various factors including repositioning of the Champs Sports banner, consumer softness, and changing vendor mix.

Despite the challenges, Foot Locker saw a notable 5.2% increase in comparable sales in its Foot Locker and Kids Foot Locker North American banners. However, the gross margin contracted by 350 basis points due to higher markdowns, partially offset by occupancy leverage.

The company recorded a net loss of $389 million, or diluted loss per share of $4.13, compared to a net income of $19 million, or earnings per share of $0.20, in the same quarter of the previous fiscal year. On a non-GAAP basis, net income for the period was $36 million, or earnings per share of $0.38, compared to $92 million, or earnings per share of $0.97, in the fourth quarter of the prior fiscal year.

Store Base Update

Foot Locker continued its store expansion and remodeling efforts during the fourth quarter, opening 29 new stores, remodeling or relocating 66 stores, and closing 113 stores. As of the end of the period, the company operated 2,523 stores in 26 countries across North America, Europe, Asia, Australia, and New Zealand. Additionally, there were 202 licensed stores in the Middle East and Asia.

Fiscal 2024 Outlook

Looking ahead, Mike Baughn, Executive Vice President and Chief Financial Officer, reiterated the company’s long-term earnings potential outlined in the Lace Up Plan. However, due to lower starting points exiting 2023, Foot Locker expects a two-year delay in achieving its 8.5-9% EBIT margin target, now aiming to reach that goal by 2028.

“As our margins and cash flows improve, we will continue to prioritize investing in our business and enhancing financial flexibility,” stated Baughn. “For 2024, we anticipate sales to be between minus 1% and 1% below the previous year, with comparable sales expected to be between 1% and 3% above the previous year.”

Despite the challenges and adjustments, Foot Locker remains committed to its strategic objectives and long-term growth trajectory, reaffirming its position as a leading retailer in the global footwear industry.